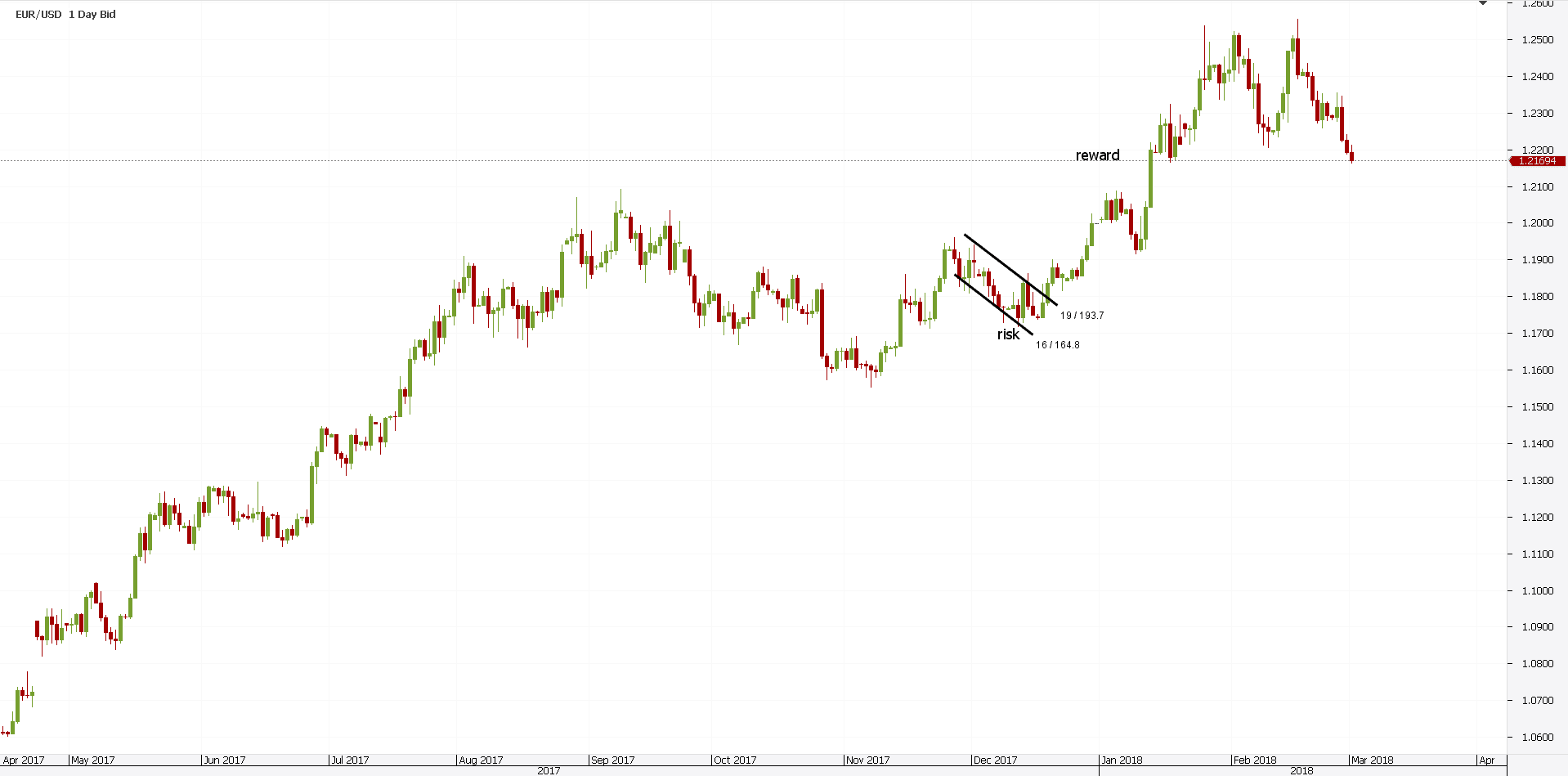

As mentioned before risk management is one of the most critical skills in trading. Essentially this is how risk management works.

Learn Easy Forex Trading Risk Reward And Money Management In Forex

In it i highlight the essential aspects of placing your stop loss the risk to reward ratio and moving your stop loss to decrease the risk to reward.

.jpg)

Forex risk management example. Think of it for a sec. This is a classic example of how s! tatisticians make money over gamblers. This is a practical easy to manage day to day example of making a trade with relatively easy management of risk.

This article focus on a risk management example its supplement of forex trading strategies guide not a complete strategy please do not trade directly only according to this. With the correct position sizing you can trade across any markets and still manage your risk. In fact its profitability comes from proper forex risk management.

With the correct position sizing you can trade across any markets and still manage your risk. Next youve learned that forex risk management and position sizing are two sides of the same coin. Even though both lose money the statistician or casino in this case knows how to control its losses.

And if the usd tumbles youll suffer a double dose of pain. Therefore understanding and managing forex risks become a priority. Forex risk mana! gement is the cornerstone of trading the currency market.

Any trading strategy no matter how profitable is subject to money management. If you learn how to control your losses you will have a chance at being profitable. But keeping your overall exposure limited can reduce your risk and increase your prospect for long term success.

Risk management question there is more to the determination of which of the two projects would fetch shareholders much wealth than the amounts of money being invested into the various projects and the expected net cash flow. If you go short on eurusd and long on usdchf you are essentially exposed two times to the usd. Forex risk management example.

I have provided a forex risk management example below for your consideration. Any trade has a stop loss.

1 80 01 Enterprise Risk Management Policies And Procedures Library

Assignment Final Fina3326 Applied Financial Management Studocu

Assignment Final Fina3326 Applied Financial Management Studocu

Forex Simulator Soft4fx

Forex Simulator Soft4fx

A Risk Management Example Forex Strategies Library

Risk Management Policy Pdf

Risk Management Policy Pdf

Foreign Exchange Risk Management Currency Risk Management

Foreign Exchange Risk Management Currency Risk Management

What Is Foreign Exchange Exposure Definition And Meaning Business

What Is Foreign Exchange Exposure Definition And Meaning Business

Risk Management 9 Tips To Master The Finesse Art In Forex Trading

Risk Management 9 Tips To Master The Finesse Art In Forex Trading

Trading Plan Template How To Turn Evernote Into The Best Trading

Trading Plan Template How To Turn Evernote Into The Best Trading

Solved Managing Foreign Exchange Risks The Working Of The

Solved Managing Foreign Exchange Risks The Working Of The

Enterprise Risk Management Framework

Foreign Exchange Risk Management Currency Risk Management

Foreign Exchange Risk Management Currency Risk Management

The Importance Of Forex Risk Management Forexboat Trading Academy

The Importance Of Forex Risk Management Forexboat Trading Academy