Forex Gbp Dollar

Forex Gbp Usd Fiel Wahrend Der Asien Session Vps Forex Server

Forex Trading Online Trade Fx In South Africa Cm Trading

what causes exchange rates to change since forex trading

European fx options may only be exercised on the expiration date and not earlier. Execute straddles strangles risk reversals spreads and other strategies.

Beste Forex Broker Binaere Optionen Demo Account Mauve21 Events

Forex trade option. Because options contracts implement leverage traders are able to profit from much smaller moves when usin! g an options contract than in a traditional retail forex trade. American fx options are more flexibly styled. Achten sie bei der auswahl auf eine geringe margin so binden sie nie mehr kapital als erforderlich.

Forex options allow traders to pay a premium in exchange for the ability to profit from the moves of a currency block without holding or being held liable for that block. When combining traditional positions with a forex option hedging strategies such as straddles strangles and spreads can be used to minimize the risk of loss in a currency trade. There are different fx option styles which you can classify.

Retail forex traders who intend to trade options online should research prospective brokers. Forex trading tipps tricks. In deutschland ist das meistgehandelte instrument der dax30 cfd uber den sie sie ahnlich zu forex mit long und short trades auf steigende und sinkende kurse setzen konnen.

Not all r! etail forex brokers provide the opportunity for option trading! . Trade more than 40 currency pairs and any combination of call and put options in one account to create your optimal portfolio. Neben forex sind bei fast allen forex cfd brokern auch weltweite indizes rohstoffe wie gold und ol und viele weitere zum handel verfugbar.

Therefore every single currency pair trades both as a call and put. Fur den devisenhandel brauchen sie einen forex broker.

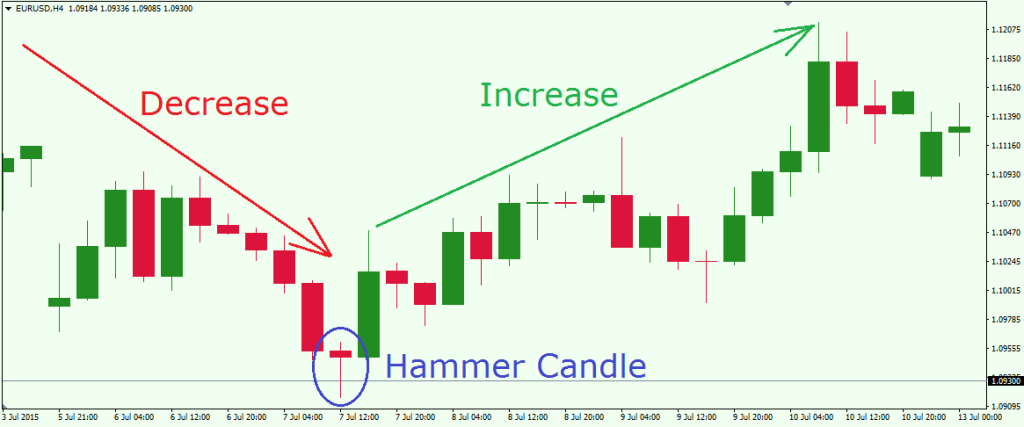

2 trading with messy vs clean forex charts. Price action trading strategies are a method of trading that uses an analysis of price movement to form the basis of a trading method.

Price Action Forex Trading Method Tutorial Pa Strategy

Trading forex with price action. Start by looking left on your chart for significant levels usually violent price rejection! in the form of pin bars where you can expect the price to react. Everything you need to learn how to trade with price action. 3 how to identify trending and consolidating markets.

A demo account is intended to familiarize you with the tools and features of our trading platforms and to facilitate the testing of trading strategies in a risk. While we have covered 6 common patterns in the market take a look at your previous trades to see if you can identify tradeable patterns. I show you how you can use price action to master forex trading.

Find out why price action is important in forex trading and why you need to know about it. In this webinar i cover the basics of my price action trading strategy. Price action trading guides articles tips and trading strategies.

The key thing for you is getting to a point where you can pinpoint one or two strategies. Price action trading course save 50 ends 11 august. Tradin! g with price action can be as simple or as complicated as you ! make it.

This style of trading works on everything from a 1hr intraday chart all the way to the monthly chart. Price action trading also involves taking trades when the price shows reactions at critical price levels. Price action trading explained.

Everything you need to learn how to trade with price action. 1 the definition of price action. Learn some of my best secrets for price action in forex trading empowering you with knowledge to help you master candlestick charts.

You can choose either to buy a certain stake per pip as a spread bet or to buy a certain number of cfd contracts at the offer price of 120510. Currency values rise and fall in relation to each other and in response to national and international economic financial and political events.

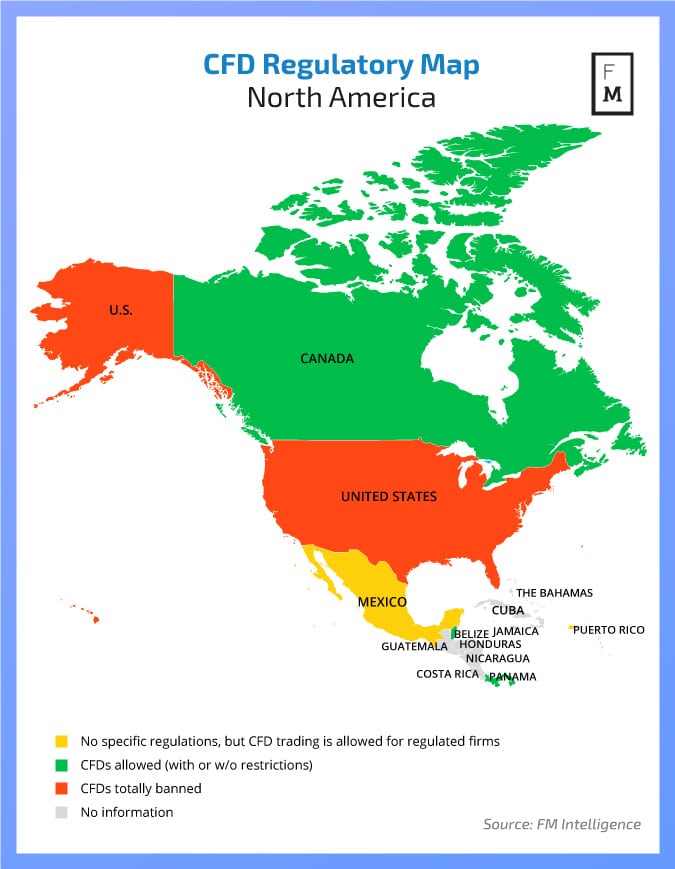

Where Brokers Can Offer Cfds Around The World Regulations

Where Brokers Can Offer Cfds Around The World Regulations

Forex cfd trading example. Forex trading allows you to speculate on price movements in the global foreign exchange market. Take a better position. Find out more here.

Remember that if the price moves against you it is possible to lose more than your initial position margin of 56750. Open an account with a market leader in cfd fx and binaries. The forex market is traded 24 hours a day 5 days a week with an extraordinarily large liquidity traded daily at over 4 trillion dollars exchanging hands every day.

Enhance your forex trading knowledge with these scenario based examples. Forex cfd trading description. You will learn about the margin leverage and of course the overnight financing.

Cfd trading examples in 2018 will open the door to what is possible and allow you to learn to trade cfds confidently in an easy to understand format. Forex trading example forex t! rading allows you to speculate on price movements in the globa! l foreign exchange market. Eurusd is trading at 113010 113020.

Well take a look at forex indices and share cfds. Cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 8017 of retail investor accounts lose money when trading cfds with this provider.

Currency values rise and fall in relation to each other and in response to national and international economic financial and political events. If you find product dealsif at the time will discount more savings so you already decide you want have forex cfd trading for your but you dont know where to get the best price for this forex cfd trading. Another similarity between cfd trading and forex trading is that the only cost of trading is the spread as opposed to other types of trading instruments that charge commissions and other finance fees.

Forex cfds are exciting and offer traders excellent opportunities. To help you unde! rstand how forex trading works view our cfd examples below which take you through both buying and selling scenarios.

Forex Brokers Forex Trading With A Rand Based Trading Account

The Currency Trader S Handbook Strategies For Forex Success Forex

The Currency Trader S Handbook Strategies For Forex Success Forex

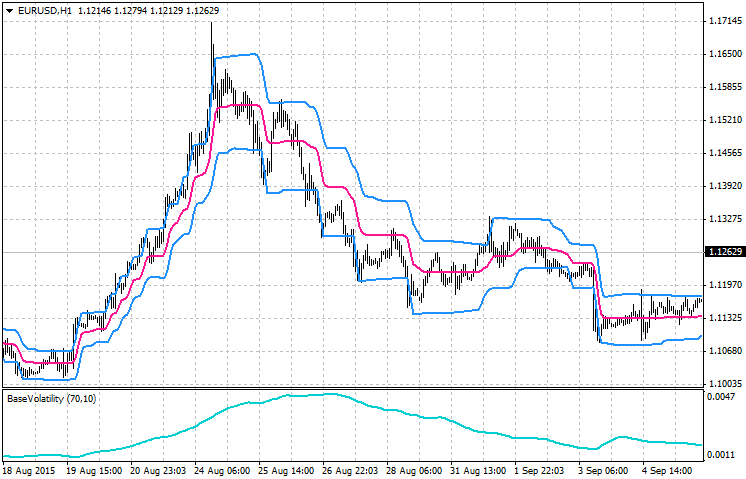

But if we are solely focussed on volume then the best volume indicator is the one selected in the image. Forex volume indicators volume indicators are used to determine investors interest in the market.

7 Popular Technical Indicators And How To Use Them To Increase Your

7 Popular Technical Indicators And How To Use Them To Increase Your

Volume volatility indicator forex. Were going to use a ma! period of 34 periods while for the value variable were going to use a 05 period. The others utilise volume as part of their calculations. As you can see from the image above there is more than one volume indicator available.

Volatility indicators show the size and the magnitude of price fluctuations. The volatility mt4 indicator settings. Volume volatility the most important parameter is volumevolatilityfactor this parameter in big simplification determines how distant past is analyzed.

Im a trend trader so i need to detect where theres volume in the market. If youre a trend trader like we are youll need a volume indicator to trade forex and youll need it badly. The volumes indicator is the one were interested in as it purely concerns itself with tick volume.

In any market there are periods of high volatility high intensity and low volatility low intensity. This video was made for traders who have gone throug! h all of the material so far. Hi all im looking for a good vol! umevolatility indicator to help get me into the best trends and to avoid losses.

High volume especially near important market levels suggests a possible start of a new trend while low volume suggests traders uncertainty andor no interest in a particular market. If you know how to determine if enough of it is there for you to make a good trade you can move mountains. Forex volatility indicators are now in play as they attempt to do the same thing for us that volume indicators do.

The preferred settings for the volatility mt4 indicator are the default settings. Volume indicator forex in the forex market we dont have a centralized exchange of total volume because were trading over the counter. If we look at any trading platform like tradingview they have a volume attached to their chart.

SUBCRIBE VIA EMAIL